In the final weeks of 2020, it was clear COVID-19 had affected every person in some way: physically, financially, emotionally. Amid the volatility of the year, U.S. retail sales rose and fell dramatically and ultimately ended on a positive note for home improvement operators. Throughout 2020, shifting retail trends and local safety ordinances pushed operators to see their businesses from new vantage points and redefine the customer experience entirely.

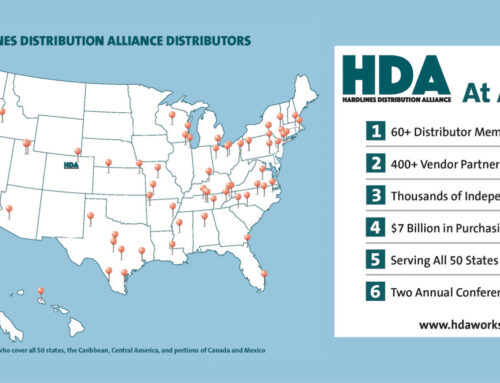

As the months continued, insight emerged. Behind each graph was a story; behind each data point a retailer who had persevered and met new shopper demands safely throughout 2020. As a new year begins, review some key retail findings from trusted institutions, including The Farnsworth Group and the Home Improvement Research Institute, to discover how the pandemic reshaped retail.

See the data in motion with the story of Chris Hyatt, owner of Hemly Hardware in Ohio. Learn how he oversaw a massive store expansion virtually and entered 2021 a more capable retailer and turned his new location into a true destination. Plus, get insights on how you can continue the sales momentum of 2020 into the new year.

Home improvement retail proved essential.

On March 16, leaders from the North American Hardware and Paint Association (NHPA) and every major home improvement co-op and wholesaler banded together in an open letter to campaign for state lawmakers to deem home improvement businesses as essential operations.

Soon after, government leaders across North America deemed home improvement stores essential, acknowledging the integral role home improvement retail plays in not only the economy, but also in the needs of an entire society. It was a key moment that both unified retailers across the world to continue serving safely, and led to strong sales throughout the year.

In June, U.S. Census Bureau data showed home improvement sales soared nearly 20 percent higher than in 2019, the highest month-to-month sales increase observed for the sector last year. As of October, home improvement sales hovered more than 13 percent higher than at that point in 2019, proving while painful and hectic, 2020 was a banner year for industry sales.

Earlier this year, NHPA surveyed roughly 300 retailers across the industry, representing 1,500 storefronts. nearly 90 percent of retailers reported a year-to-date sales increase in 2020, with the average sales increase hovering just above 24 percent.

Conversely, other retail sectors that were not deemed essential saw stark spring sales declines. Clothing stores (NAICS 448) saw sales drop more than 86 percent from April 2019 to April 2020. Additionally, sporting goods stores, bookstores and music stores (NAICS 451) saw sales plummet nearly 45 percent in the same period, according to the U.S. Census Bureau.

Shoppers saw their homes in a new light.

After home improvement stores across North America were given the green light to continue sales while social distancing and following other safety measures, customers began to arrive in droves, in search of the items they needed to reimagine their homes into offices, gyms, classrooms and entertainment centers.

For shoppers who now needed to convert their homes into offices and classrooms, storage devices became increasingly important and many retailers saw a run in that category. Small electrical goods like power strips rounded out those sales, helping keep consumers connected to colleagues, classmates and family.

Shoppers with time on their hands found returning to classic categories like lawn and garden, paint and electrical to be rewarding. Retailers saw opportunities to organically increase transaction size among a new class of engaged shoppers.

Customers also wanted the bare essentials to protect their spaces from COVID-19. Almost every home improvement retailer can share a story about an initial run on N95 masks and cleaning supplies. In addition, consumables and paper products were also critical for this category of shopper.

From buying additional business equipment and increasing employee bonuses to making structural improvements and investing in technology, retailers saw new paths forward for their businesses.

New opportunities emerged for retailers.

Even with the burden of COVID-19, retailers didn’t sit idle through the events of 2020. Roughly 33 percent of retailers sought to use tax mitigation strategies in 2020 as sales increased, data from NHPA shows.

That was the case for Chris Hyatt, owner of Hemly Hardware in Thompson, Ohio. Like many other retailers, he saw an immediate rush on cleaning supplies and N95 masks in March, followed by a lull in sales. But, as spring arrived, sales rose again.

Throughout the tumult of COVID-19, Hyatt and his team were busy converting to a new wholesaler and moving from the location they had occupied for years into an entirely new facility. In October 2019, construction began on a 24,000-square-foot facility to fit Hemly Hardware’s inventory and create a true shopping destination for Thompson and surrounding communities.

As COVID-19 began to spread throughout the U.S. and necessitate social distancing, only the walls of the new facility were complete. Hyatt and his team had to oversee the final pieces of the construction puzzle virtually, collaborating remotely with designers and construction pros to ensure the store’s location not only met their initial vision, but could also pivot to serve customers through the pandemic.

“We had to design the store virtually,” Hyatt says. “We spent hours on the phone, going through every section of the store item by item.”

The new facility balances a home improvement operator’s basic needs with shopper-focused details. A stamped concrete walkway resembles wood planks, welcoming customers inside. Elsewhere, LED lighting under the company’s perimeter racking features rocker-style switches, making it easy for associates to quickly turn lights on and off with their feet.

The new location gave Hyatt the opportunity to expand existing categories. The Hemly Hardware team was able to double the size of its existing workwear and shoe department in the new space.

It also gave them space to introduce a completely renovated paint department, quadrupling the size of its former offering. Data from The Farnsworth Group shows paint and sundries was one of the most popular DIY home improvement categories during the pandemic, and Hemly Hardware was able to meet that rejuvenated demand.

“We bought the newest technology in paint mixing machines and started offering paints. We had mixed paint very little paint before, so adding that equipment has revived this service,” Hyatt says.

Local businesses gained new prominence.

In the days leading up to the official opening of the new location in early June, Hyatt says he and store manager Robyn Gillett were working 20-hour days, motivated by their desire to see Hemly Hardware emerge as a one-stop shop for DIYers and pros across Thompson.

“We had a vision, and we weren’t going to let anything slow us down,” Hyatt says. “We knew we were going to get it done and we did.”

This move allows Hemly’s industrial tooling, hardware and trucking divisions to be located side by side, making the customer shopping experience truly a one-stop shop no matter what product or service customers need, Hyatt says.

While customers were seeing new possibilities from their local home improvement stores, the Hemly Hardware team was no exception. Gillett says the company relied largely on local construction crews, and that decision was an advantage in the long run as construction crews were smaller and able to socially distance.